Foxi-Fi is a cutting-edge software technology company specializing in scalable, intelligent, secure, and modern software solutions for financial service providers, across Forex, Stock, Crypto, Funds, Payments, Exchange, Remittance, and other New innovations.

End clients growth trend

Over last 18 months

End clients funds growth trend

Over last 18 months

Monthly transactions trends

Over last 18 months

Rapidly Launching

Fully Modulated

Smart Automation

Seamless Integrations

Next-Level User Exp

Global Ready

Insight-Driven

Cost Efficient

Highly Secured

Forex CFD

Stock spot/CFD trade

Crypto spot and leverage trade

Global payments and remittance

Quant trade and risk control

Social and copy trade

Crypto loan,staking, and earns

On/off ramp

Compliance and risk management

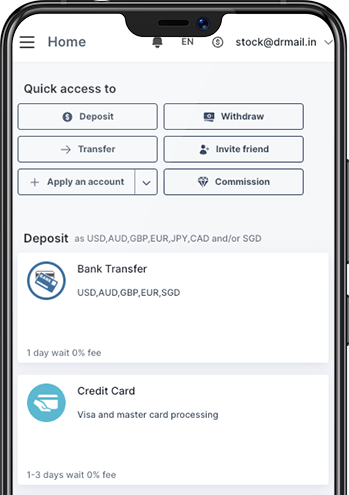

(Pre-packaged) Financial mobile apps

Customer onboarding

Online KYC/KYB/AML

Lead management

360 degree customer management

Account and fund management

Beneficiary management and screening

Multi-level IB and commissions

Regulation and risk management

(Integrated) Payment channels

Customer interactions and ticket management

Automated workflows with task and approval boards

Secured and regulated document management

Integration APIs and API explorer

Notifications, announcements, news and ADs

Access Control and Security

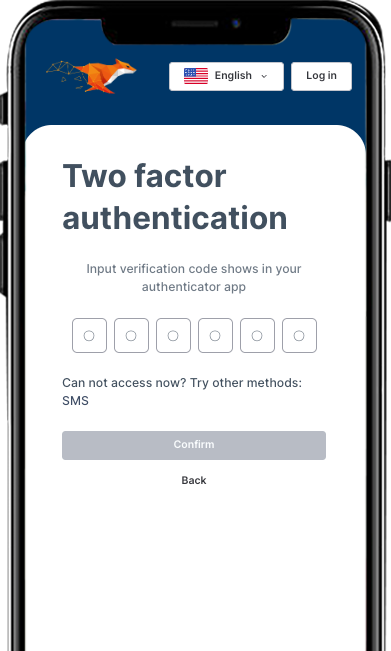

Fast, flexible, and branded.

Ready-to-launch mobile app powered by Finance One

Fully white-label – match your brand instantly

Supports Forex, Payments, Crypto, and more

Integrated with onboarding, KYC, wallets, and support

Seamless customer experience across all financial services

Built-in security with biometrics and 2FA

Cross-platform: iOS and Android ready

MetaQuotes MT4/5 APIs:

REST APIs for MetaQuotes MT4 and MT5 to simplify your solutions.

Integrations

Saving your time for R&D integrations 3rd parties. Reach out to us for integration practices for many.

UI Components

Boost the user experience with our modern modern UI components.

Cybersecurity upgrade

Maximise the Cybersecurity for your fintech system/pltform running in AWS.

Tailor-made Fox CRM to match your brand

Customize payment channels, UI/UX, KYC/KYB providers, IB structures, and compliance policies for different regions—all fully white-labeled to your needs.

Build and launch exclusive financial services, fast

Use Finance One’s modular infrastructure to rapidly deploy your own financial products—whether from our prebuilt solutions or your custom ideas.

Launch your branded mobile app—fast

White-label our iOS and Android-ready app to deliver a seamless, branded experience. Start with Mobile One and make it truly yours.

From concept to

product—built by fintech experts

Bring your fintech vision to life with our dedicated team, specialized in building secure, scalable, and modern financial platforms.

The monthly subscription fee for FOX CRM are calculated using the following formula.

| Clients' range | Ratio |

|---|---|

| Activated clients 0~500 | 0.3 |

| Activated clients 501~2,000 | 0.5 |

| Activated clients 2,001~5,000 | 0.8 |

| Activated clients 5,001~8,000 (Standard) | 1 |

| Activated clients 8,001~12,000 | 1.2 |

| Activated clients 12,001~15,000 | 1.5 |

| Activated clients 15,001~20,000 | 1.8 |

| Activated clients 20,001+ | 2 |

For example, if a CFD broker selected a group of function modules with $3,000 USD/month of subscription fee, for a month start, the actual activated clients’ range is 8,088, with ratio of 1.2, then this CFD broker’s month subscription fee is: USD3,000 * 1.2 = USD 3,600.

For more details of Fox CRM modules and Finance one, please contact sales: sales@foxifi.io

Are you looking for an exciting role? Here are amazing opportunities to become part of a thriving business with a great culture! Check and apply now.

View Exciting Opportunities